capital gains tax changes 2021

Your 2021 Tax Bracket to See Whats Been Adjusted. The exemption amount for those married.

What You Need To Know About Capital Gains Tax

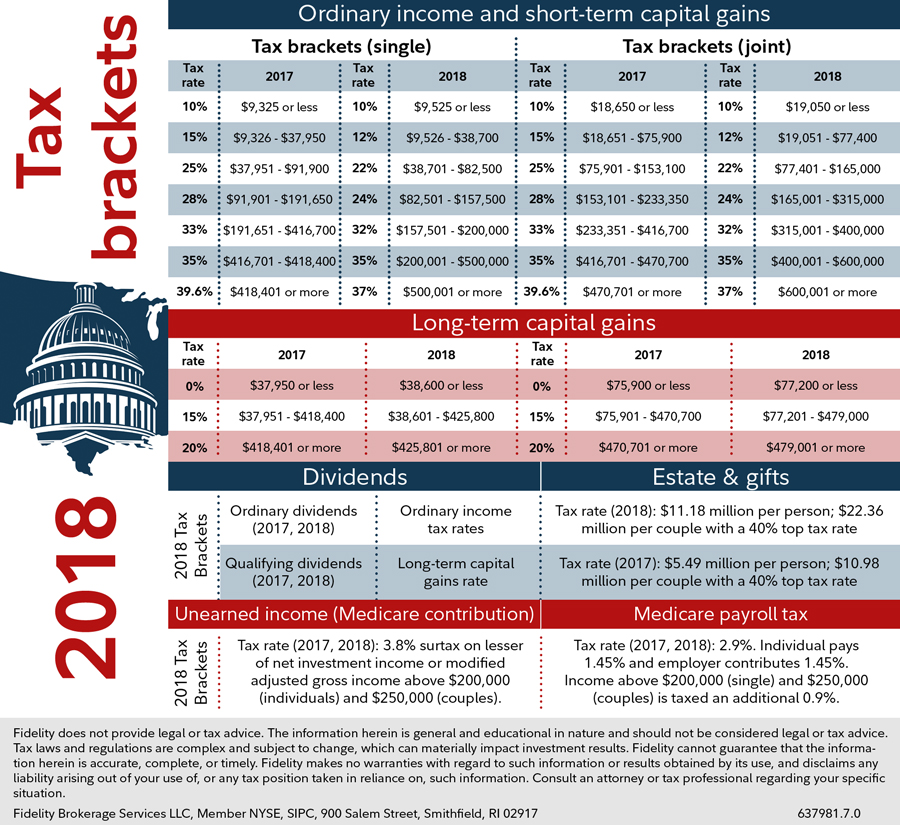

You will be taxed at your ordinary income tax rate on short-term capital gains.

. The effective date for this increase would be September 13 2021. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. Aside from annual inflation adjustments there arent any significant capital gains tax changes on tap for 2021.

This tax change is targeted to fund a 18 trillion American Families Plan. If you sell small-business stocks or collectibles the maximum capital gains tax rate is 28. The proposal would increase the maximum stated capital gain rate from 20 to 25.

The rates do not stop there. SEE MORE What Are the Income Tax Brackets for 2021 vs. Rates for long-term capital gains are based on set income thresholds that are adjusted annually for inflation.

On April 28 2021 Joe Biden proposed to nearly double the capital gains tax for wealthy people to around 396. No effective date for the change in capital gain tax rates for individuals was mentioned on the campaign trail or in President Bidens American Families Plan speech or fact sheet but the. The long-term capital gains tax rate equals 15 for most taxpayers on most types of capital gain.

Discover Helpful Information and Resources on Taxes From AARP. Its one of the biggest tax changes in more than a decade for Colorado. 2021 and 2022 Tax Brackets and Other Tax Changes.

Bidens Plans to Increase Rates for Wealthy Americans. President Joe Biden recently announced his individual tax proposals which include a 396 long-term capital gains tax rate the elimination of the. If you realize long-term capital gains from the sale of collectibles such as precious metals coins or art they are taxed at a maximum rate of 28.

Since the 2021 tax brackets have changed compared with 2020 its possible the rate youll pay. When the NIIT is added in this rate jumps to 434. Ad Compare Your 2022 Tax Bracket vs.

For 2021 the exemption amount for single filers is 73600 and the income at which exemption begins to phase out is 523600. Colorado taxpayers can be exempted from paying state taxes on capital. Capital Gains Taxes on Collectibles.

4 rows In 2021 and 2022 the capital gains tax rates are. Under President Bidens proposal the highest tax rate for capital gains would increase to 396 up from a top rate of 20 currently. Individuals with taxable income of less than 40400 80800 for married.

Residential Indians between 60 to 80 years of age will be exempted from long-term capital gains tax in 2021 if they earn Rs. 2021 federal capital gains tax rates. Add this to your taxable.

Long-term gains still get taxed at rates of 0 15 or 20. 2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe Income and Capital Gains Tax returns for the year 2010 to 2011 and later years. The Lowdown on Capital Gains Tax Rates for 2020 and Beyond.

Upload Edit Sign PDF Documents from any device. Estimate capital gains losses and taxes for cryptocurrency sales Get started Comenzar en Español. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

Ad Single place to edit collaborate store search and audit PDF documents. Its been around for a hundred years with the exception of a crazy moment in the late 1980s when the greatest tax. Additionally a section 1250 gain the portion of a gain.

Know what tax documents. The maximum zero rate amount on adjusted net capital gains for 2021 for married persons was 80800 for joint. Its important to note that Biden is also proposing a tax hikethat will raise the top income tax bracket from 37 to 396.

As a business seller if you are in. While the way capital gains taxes are treated may change in 2021 those who had previously been in either the 0 or 15 categories will likely see no change. President Biden is expected to include a capital gains.

In his budget plan released May 28 Biden proposed making the capital gains tax changes retroactive to April 2021 in order. May 11 2021 800 AM EDT. First deduct the Capital Gains tax-free allowance from your taxable gain.

Page 1 of 2. The capital gains break is as old as Methuselah in tax terms.

How To Pay 0 Capital Gains Taxes With A Six Figure Income

Pin By Jackie Kittle On Financials Tax Brackets Capital Gains Tax Capital Gain

Govt Unlikely To Change Ddt Cap Gain Tax Capital Gains Tax Capital Gain Government

What You Need To Know About Capital Gains Tax

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Exemption From Capital Gains On Debt Funds Paisabazaar Com

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

How To Pay 0 Tax On Capital Gains Income Greenbush Financial Group

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Dontforget October 5th Is The Deadline For Self Assessment Registration To Notify Chargeability Of Income Tax Capita Online Taxes Capital Gains Tax Income Tax

Capital Gains Tax On Gifts Low Incomes Tax Reform Group

Best Personal Finance Services In 2021 Accounting Services The Borrowers Capital Gains Tax

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Capital Gains Tax What It Is How It Works Seeking Alpha

Tax Planning Services In Delhi Ncr Tax Advisory Company Delhi In 2021 How To Plan Tax Consulting Tax Preparation

Pin By The Taxtalk On Income Tax Income Tax Capital Gains Tax Capital Account

Capital Gains Tax What Is It When Do You Pay It

What Are The Capital Gains Tax Rates For 2020 And 2021 Financial Stocks Stock Market Capital Gains Tax

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)